The benefits of using a receivable factoring company versus a bank loan

If you are looking for a convenient way to obtain business capital, receivable factoring is one of the best options available out there. From a recent study, it has been identified that many people go for bank financing in such instances, considering that it is the least expensive method of investing. However, receivable factoring is associated with many other advantages and we will let you know about them through this article.

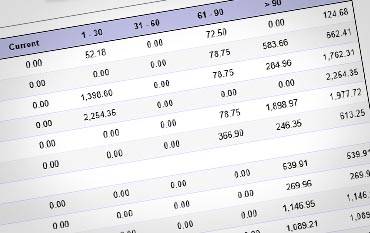

A proper cash flow is something that every business in the present world should have. In addition, they need to speed up their cash flows along with time. Otherwise, it will not be possible for them to get banks for financing. Unfortunately, banks are not in a position to accommodate all the financial requirements of a company, due to tough credit standards. That is where receivable factoring comes into play. It happens when a company sells its accounts receivable to a bank or a receivable factoring company. The amount that can be taken depends on value of the invoice.

Key benefits associated with receivable factoring

• A company can get large amounts of capital through receivable factoring. It is because this method is entirely based upon accounts receivable. It has impressed many small scale businesses out there since they can obtain a bigger line from their accounts receivable for services or goods. They will not be able to get such a big amount of capital from any conventional bank lender out there. receivable factoring is something that is based on the credit strength of your potential customers. If your company has more potential customers with healthy credit strengths, you can easily enjoy the benefits of receivable factoring.

• receivable factoring is quicker than traditional bank loans. Since most of the receivable factoring lines are in a position to be set up, approved and actively funded within a matter of few weeks, you can go through a hassle free process. However, banks will take more time to engage with their credit reviewing activities about your company. They might even wait for audit results or fiscal period closes. Therefore, if you are in need of quick business capital, receivable factoring is the number one option available out there to consider.

• receivable factoring is something that expands quickly along with the growth of your company. Almost all the receivable factoring companies out there support it. Your company doesn't need to have an excellent track recording of business. You just need to select a receivable factoring company that is big enough to accommodate all your business development ambitions.

• A receivable factoring company does not offer loans to their clients. Therefore, you cannot find many similarities between a loan and receivable factoring. A receivable factoring company will purchase your accounts receivables along with cash. Therefore, it can be considered as a similar process to increasing the working capital, while showing it as a liability in the account balance sheets. This will even reduce debt in the balance sheet, when compared to borrowing. At the end of the day, your company will get the opportunity to enjoy a lower debt to equity ratio.

• receivable factoring is less expensive than equity. Most of the businesses approach equity investors to cater their financing requirements. However, there isn't any substitute for equity capital in some expansion purposes and business investments. Almost all the equity investors expect a higher

return from the accounts receivable than the cost. When it comes to receivable factoring arrangements, you won't be able to find any dilutive effect on shareholders. This will assist you a lot to stay away from hassle.

• receivable factoring is also recognized as one of the best options available to improve your turn. In the present world, many receivable factoring companies will verify invoices with your customers and check whether they are being paid on time. This will motivate your customers to pay the invoices on time through a gentle reminder. This will result in a better service delivery from your end as well.